Archive for the ‘las vegas sands’ Category

>Las Vegas Sands (LVS) Has An Ace Up Its Sleeve

>

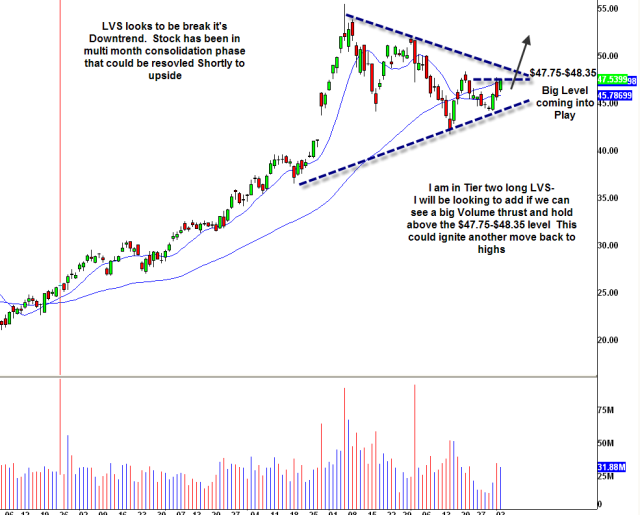

Las Vegas Sands Corp (NYSE:LVS) has been in a corrective process since hitting the $55 area in early November. Since then the stock has put in a series of higher lows and the pattern is getting very tight. This stock moves fast and is tricky. We had a lot of success riding this last year from the $19 area. Recently it’s just been a choppy trade in both directions.

This wedge is almost complete and we should get a directional move soon. I’m long and will be looking to add above $47.75 (yesterday’s high) and then confirmation above $48.35 (12/21 high) to break the trend. This stock whips around but rewards you if you’re on the right side. I hate trying to anticipate some moves, but unfortunately when it comes to this stock, I break a few rules. My stop would be $45.75.

*DISCLOSURE: Long LVS

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs.

>Americans ‘Rock the Vote’, Stocks Wait For Result

>

Stocks rose steadily overnight ahead of election day, and held onto those gains during market hours, holding in a tight range near rally highs. Las Vegas Sands Corp (NYSE:LVS) extended recent gains by nearly 4% to top our go-to list, but overall the action was tepid. Apple Inc (Nasdaq:AAPL) was another trade intra-day traders highlighted in the morning as it opened up above the recent mini-downtrend, but like most of its fellow tech leaders it saw only modest follow-through as investors were hesitant to go risk-on ahead of election results.

The dollar opened down near recent lows, which mirrored the overnight rise in US equities. The two have developed a highly correlated inverse relationship in recent months, it will be interesting to see if we can get a de-coupling of that relationship over the next year (and which direction they would trade in tandem). While a depreciation of the greenback is part of the natural re-balancing of the world economy, aggressive money printing to achieve that objective could have long-run inflation implications, which doesn’t seem to worry the deflation-paranoid FOMC. Bill Gross, for one, stated his opinion that the dollar could see as much as 20% more downside.

For the past several trading days, the markets have shown indecision ahead of the two hyped events: mid-term elections, where Republicans are expected to wrest back control of at least the House, and the Fed announcement on QE 2.0, which most expect to come in light of previous fears, err, expectations. Despite slightly lower predictions for QE2, the market has yet to show any concern, and it will be interesting to see what the reaction is if the number comes in light. Recent economic data has actually shown signs of a hastening recovery by some metrics, as the ISM Manufacturing survey yesterday was the latest indicator to show more rapid expansion. The Fed has thus far been able to prop up asset prices through dovish language, and now it seems that may have been enough to get them through the most fragile stages of the recovery.

But that is not to say we are out of the woods, especially in regards to housing and the foreclosure crisis, which could stick banks with another round of massive losses. The revelations of widespread fraud in the mortgage market are deja vu for Americans who have grown skeptical of leaders and regulators who have proven themselves corrupt and/or inept in correcting the real problems at the heart of the financial crisis. Well, America will find its voice tonight when election results become official, and it was be interesting to note what the change in political climate will be with Republicans emboldened in their quest for complete obstruction of Obama administration policy goals. In terms of the market, history says gridlock will be, contrary to what media talking heads would lead you to believe, bad for the market, especially at a time when policy action and regulatory overhaul are so important in efforts to move this country forward. But hold on to your britches folks, because the real fireworks will come tomorrow on the heels of the two-day FOMC meeting. No matter what the outcome is, the reaction of the market is the real wild-card.

>No Compelling Setup

>

By: Scott Redler

After two harsh down days, traders were hoping for a gap down into important support to make it a easy scoop long. 1085ish was the level I was hoping to buy with open arms considering we were just at 1131 Monday. So with this muted open and Fed Announcement midday–we will need extreme patience for the right setup.

Some damage has been done in Tech and I don’t see any clear cut set ups. AAPL and BIDU are acting the strongest.

Banks still can’t sustain a bounce- but watch action close for news from Washington.

Casino’s don’t have a set up. LVS broke upper laggard and MGM and WYNN are rangebound.

OIH had a 7 point pull in with BP holding 29 still. Nice short yesterday, now I’m not sure.

Gold is tricky right here. It’s still in a uptrend but watch close, pretty potent down day Monday. I am only in tier one long- I sold cash flow tier on the open Monday into the gap up. If GLD were to break 119.50-120 gold can be in short-term trouble.

The best set up would be if market goes negative – trades thru yesterday’s lows and accelerates into my buying zone and reverses to close strong. We shall see.

You’re better off watching the U.S. soccer game today.

>Past Resistance is Today’s Support

>By: Scott Redler

Yesterday we were looking at 1,150 on the S&P to hold and “surprisingly” it did–and fast. The Nasdaq didn’t even get to its breakout level of 2,325. THIS IS A STRONG MARKET with lots of new setups and stocks keep taking turns. Then, they rebuild a new setup.

The Rundown:

- Apple (AAPL)–was the first stock up yesterday. This leader gave you clues that the market can bounce. It’s now spent almost two weeks in a new upper level. I do see a new pattern for a momentum move–$226-227 is the area to clear to get this momentum mover back on the march.

- Amazon (AMZN)–I nibbled yesterday and will add above $131 and $133.

- Baidu (BIDU)–is all news and choppy. Looks like prices will move higher, but it’s hard to trade.

- Intel (INTC)–is still hanging tough. Looks like $23 is next after our $21-21.50 buy.

- Google (GOOG)–I would avoid it. See how the stock handles $556. It could get pressured if it stays below that area, but it’s hard to tell.

- Cisco (CSCO)–has held though above $26.50. It can continue higher.

- Research in Motion (RIMM)–still needs time. No real setup yet.

The Three Amigos–they’re no longer friends anymore.

- VMWare (VMW)–this looks like it just re-setup and could go higher above $54.

- Cree (CREE)–this continues to stair-step higher, but needs time.

- Intuitive Surgical (ISRG)–did reverse yesterday, but no setup now.

The Plastics:

- Mastercard (MA)–looks good after my last buy. It seems like we can see higher prices above $248-250.

- Visa (V)–also just had a nice pull-in since our $88.50 buy. Everyone upgraded it at $92-93, maybe they will buy it around $90.

THE CASINOS ARE ACTING AWESOMELY RIGHT NOW!

- Wynn Resorts (WYNN)–is the cream of the crop. New highs yesterday and we should see over $80 soon.

- Las Vegas Sands (LVS)–this was our Rock Star yesterday through $19.65 then through $20.20 and $20.77. It should get to $23-24 in the next few weeks. Look at the weekly, we can see $30 by year end.

- MGM (MGM)**–This is the laggard. Laggards are tough to play, but this one can catch up. I will add through $12.70-12.90 on volume for a move back to old highs at $14.

The Financials–these need some time.

- General Electric (GE) is getting setup again after a big move. This could be worth more gains above $18.10-18.40.

- Alcoa (AA)–looks ok. If it keeps holding $14 and moving up it could be worth an add avoe $14.55. Then we’ll see how it handles $14.90..

- Gold (GLD)–is not acting well. I would just keep it on the radar.

- Oil–after more time this might make new highs. It needs the dollar to relax.

- Freeport McMoran (FCX) and U.S. Steel (X)–both need more time.

>Betting on the Casinos

>By: Scott Redler

Las Vegas Sands (LVS) looks great here! They had an awesome presentation last week and I believe this sector is an excellent recovery play–with Macau and Singapore as a kicker. Technically the chart looks awesome. I am in Tier 3 and will add above $20.20ish. This one needs big volume. I would love to see it hold $20 then get a move through $20.74 for the big momentum move to $22-24.

>A Different Kind of Plastic

>By: Scott Redler

Recently the plastic was the credit card sector, this week it’s the casinos. There is a big conference this week focusing on the fundamentals of the casino sector. Technically, all three major casino stocks that we have traded for the past year look ready to move AGAIN!!

Wynn Resorts (WYNN)–this is the class of the group. A trade on heavy volume above $72 and we should see $75 quickly before making new 52-week highs.

Las Vegas Sands (LVS)–this is where I am hearing the money should be. Macua is doing great and there are no problems with Singapore. The stock is hovering below old highs. I would watch this closely. If we get a move above $19.90-$20.10 on heavy volume, we should see $21-22 quickly, and ultimately $24 before the Summer.

MGM (MGM)–this one is heavily plagued with bad headlines, BUT I love a good short squeeze. Seems like $11.95-12.05 should open this up for another move back to the $14 area or higher.

I will be hawking this sector during the week. When they move, they move quickly.

The market is a bit overbought, so this could take a few days to play out. I would like to see the S&P holding 1,135 before getting to aggressive. I’m sure Vegas owes at least some of you cash, time to make it back trading the stocks the right way!